Selecting the right location is one of the most crucial decisions when buying real estate. While property prices, builder reputation, and amenities matter, the long-term value of a property is determined primarily by the location. However, the concept of a “good location” has evolved.

Earlier, locations were chosen based on proximity to city centers or major markets. Today, buyers are seeking future-ready locations — areas that are positioned for growth, connectivity, convenience, and lifestyle upgrades.

But what does “future-ready” really mean in real estate?

Let’s explore the key factors.

1. Strong Connectivity & Transport Infrastructure

A future-ready location offers easy access to important city zones through well-developed transport routes.

Key indicators:

- Proximity to metro lines, expressways, ring roads, or highways

- Availability of public transportation

- Future infrastructure under government planning

Infrastructure projects like metro expansions, new expressways, and airport development often boost property value significantly within a few years.

Example:

Areas around the Dwarka Expressway in Delhi NCR saw appreciation even before construction was completed because of strong future connectivity prospects.

2. Presence of Employment Hubs

People prefer living near work.

Therefore, locations with IT parks, business districts, SEZs, and industrial clusters have strong real estate demand.

Look for:

- Existing tech parks or business centers

- Corporate offices shifting or expanding into the region

- Growth of startups or industry clusters

Such locations typically:

- Offer stable rental demand

- Generate higher rental yield

- See faster capital appreciation

3. Social Infrastructure & Lifestyle Convenience

A future-ready locality should support modern living needs.

Key facilities include:

- Schools and colleges

- Hospitals and clinics

- Malls, shopping markets, supermarkets

- Restaurants, gyms, and recreation spaces

Good social infrastructure not only improves everyday convenience but also makes properties more attractive for families, thereby strengthening resale and rental value.

4. Residential Mix & Community Living

Locations known for planned townships, gated communities, and organized residential clusters hold higher long-term value compared to unplanned, overly congested areas.

Benefits include:

- Better crowd profile

- Improved security

- Cleaner & greener environments

- More open spaces and walkable layouts

People are increasingly choosing communities over isolated housing due to lifestyle, safety, and comfort factors.

5. Future Development & Government Focus

Government-backed development plans are strong growth indicators.

Look for:

- Smart City initiatives

- New metro corridor announcements

- Urban rejuvenation projects

- Industrial & commercial development zones

When the government invests in a region, infrastructure improves → population inflow increases → demand rises → property appreciation accelerates.

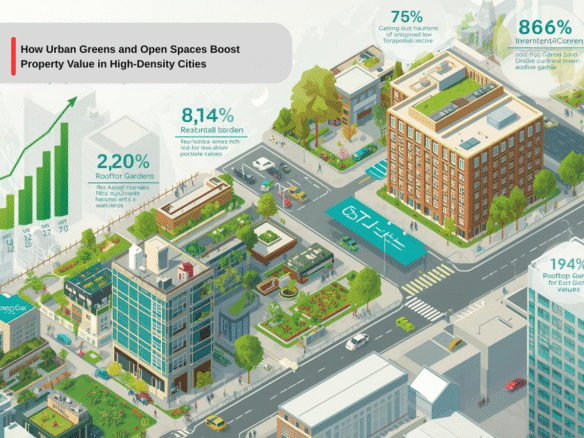

6. Green Spaces and Liveability Score

The new-age buyer values wellness, open spaces, cleaner air, and walkability.

A future-ready location should ideally offer:

- Public parks and green belts

- Jogging tracks and lakeside zones

- Less noise and air pollution

- Balanced urban density

Homes near green zones experience higher desirability and resale value.

7. Affordability Today, Appreciation Tomorrow

The ideal time to invest in a future-ready location is before it becomes fully developed.

Signs of a high-appreciation zone:

- Ongoing infrastructure development

- Migration of companies and institutions into the area

- Real estate constructions increasing gradually

- Properties still reasonably priced

Buying early ensures lower entry cost and higher value growth over time.

8. Rental Demand Indicators

To evaluate whether a location can generate strong rental income:

- Check property occupancy rates

- Review rent trends of the past 3–5 years

- Identify nearby workplaces, universities, or commercial hubs

Areas with multiple demand sources (corporates + students + families) ensure consistent rental returns and low vacancy risks.

How to Evaluate if a Location Is Future-Ready — A Simple Checklist

| Factor | Check | Why It Matters |

|---|---|---|

| Connectivity | Metro/Highway/Airport proximity | Drives convenience & value |

| Employment Hubs | IT parks, SEZs, commercial districts nearby | Ensures sustained rental demand |

| Social Infrastructure | Schools, healthcare, retail access | Improves everyday living value |

| Urban Planning | Open spaces, gated communities, clean layout | Enhances lifestyle & resale prospects |

| Government Investment | Planned public projects | Indicates long-term appreciation |

| Price Trend | Rising demand but affordable entry | Ideal for investment timing |

If a location scores well in most of these areas — it is future-ready.

Join The Discussion